Understanding The Tax Collected At Source (TCS) On Gold Jewellery Purchases

Understanding the Tax Collected at Source (TCS) on Gold Jewellery Purchases

Related Articles: Understanding the Tax Collected at Source (TCS) on Gold Jewellery Purchases

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Tax Collected at Source (TCS) on Gold Jewellery Purchases. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Tax Collected at Source (TCS) on Gold Jewellery Purchases

In India, the purchase of gold jewellery is subject to a Tax Collected at Source (TCS) levied by the government. This mechanism, introduced as part of the Union Budget 2020-21, aims to enhance tax compliance and ensure that individuals pay their due taxes on transactions involving precious metals.

This article delves into the intricacies of TCS on gold jewellery purchases, providing a comprehensive understanding of its implications and how it impacts buyers.

What is TCS?

TCS, or Tax Collected at Source, is a mechanism where a seller collects tax on behalf of the government at the time of a transaction. The seller then deposits this collected tax with the government. This ensures that taxes are collected at the point of sale, simplifying the tax collection process and minimizing tax evasion.

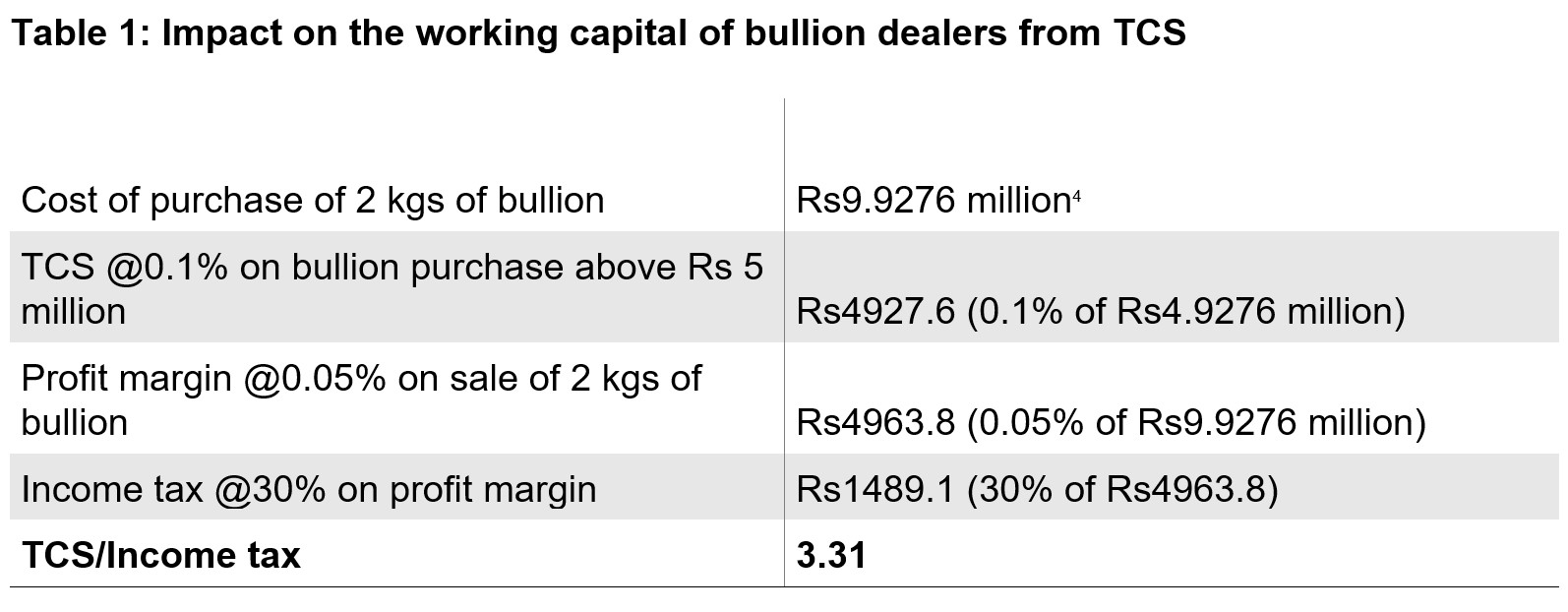

TCS on Gold Jewellery: A Detailed Explanation

The TCS applicable on gold jewellery purchases is 1% of the transaction value exceeding ₹50,000, effective from 1st October 2020. This implies that if you purchase gold jewellery worth ₹60,000, a TCS of ₹1,000 will be levied.

Who is Liable to Pay TCS?

The responsibility of paying TCS lies with the seller, typically a jeweller. They are required to collect the applicable TCS from the buyer at the time of the transaction and deposit it with the government.

How is TCS Calculated?

The TCS calculation is straightforward. It is calculated as 1% of the transaction value exceeding ₹50,000.

Example:

If you purchase gold jewellery worth ₹75,000, the TCS applicable would be:

- Transaction value exceeding ₹50,000: ₹75,000 – ₹50,000 = ₹25,000

- TCS at 1%: ₹25,000 x 1% = ₹250

TCS on Gold Jewellery: Importance and Benefits

The TCS on gold jewellery purchases holds significant importance for both the government and the individual:

- Increased Tax Revenue: The TCS ensures that the government collects tax revenue on transactions involving gold jewellery, which was previously not fully captured. This contributes to the government’s overall tax revenue, which is crucial for funding public services and infrastructure development.

- Improved Tax Compliance: By collecting taxes at the point of sale, TCS promotes tax compliance. It eliminates the need for individuals to calculate and pay their taxes separately, simplifying the tax payment process and minimizing tax evasion.

- Transparency and Accountability: The TCS mechanism promotes transparency and accountability in the gold jewellery market. It provides a clear record of transactions and ensures that the government receives its due share of taxes.

TCS on Gold Jewellery: FAQs

1. Is TCS applicable on all gold jewellery purchases?

No, TCS is applicable only on purchases of gold jewellery exceeding ₹50,000. Purchases below this threshold are exempt from TCS.

2. Who is responsible for paying TCS?

The seller, typically a jeweller, is responsible for collecting and paying TCS to the government.

3. Can I claim a refund of the TCS paid?

Yes, you can claim a refund of the TCS paid if you are eligible. You can claim the refund while filing your income tax return.

4. How can I claim a refund of the TCS paid?

To claim a refund, you need to fill out Form 26AS and submit it along with your income tax return. The TCS amount will be reflected in Form 26AS, and you can claim a refund based on your overall income tax liability.

5. What happens if the seller fails to collect TCS?

If the seller fails to collect TCS, they will be liable to pay the tax along with penalties.

Tips for Understanding and Managing TCS on Gold Jewellery Purchases:

- Be aware of the TCS threshold: Ensure you are aware of the threshold value above which TCS is applicable.

- Ask for a TCS receipt: Always request a receipt from the seller confirming the TCS amount paid. This receipt will be essential for claiming a refund.

- Keep track of your gold jewellery purchases: Maintain records of all your gold jewellery purchases, including the date, value, and TCS paid. This will help you in claiming a refund and managing your tax liability.

- Consult a tax professional: If you are unsure about your tax obligations or need assistance with claiming a refund, seek advice from a qualified tax professional.

Conclusion

The TCS on gold jewellery purchases is an important mechanism for ensuring tax compliance and contributing to the government’s revenue collection. Understanding the TCS rules and regulations is crucial for individuals purchasing gold jewellery. By staying informed and following the guidelines, buyers can navigate the TCS process effectively and ensure they are fulfilling their tax obligations.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Tax Collected at Source (TCS) on Gold Jewellery Purchases. We hope you find this article informative and beneficial. See you in our next article!