The Essential Guide To Jewellery Valuation For Insurance

The Essential Guide to Jewellery Valuation for Insurance

Related Articles: The Essential Guide to Jewellery Valuation for Insurance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Essential Guide to Jewellery Valuation for Insurance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential Guide to Jewellery Valuation for Insurance

Owning valuable jewellery is a privilege, but it also comes with the responsibility of safeguarding it. Insurance plays a crucial role in protecting your investment, ensuring peace of mind in the event of loss or damage. However, obtaining adequate insurance coverage requires a thorough understanding of jewellery valuation. This comprehensive guide delves into the intricacies of jewellery valuation for insurance purposes, equipping you with the knowledge to make informed decisions and secure appropriate protection for your prized possessions.

The Significance of Jewellery Valuation for Insurance

Jewellery valuation serves as the cornerstone of insurance coverage. It establishes the monetary value of your pieces, determining the amount of compensation you receive in case of loss or damage. An accurate valuation ensures that you are adequately reimbursed for the actual value of your jewellery, preventing financial hardship and potential disputes with your insurer.

Methods of Jewellery Valuation

There are several methods employed for jewellery valuation, each with its specific advantages and considerations:

1. Appraisal by a Qualified Gemologist or Valuer:

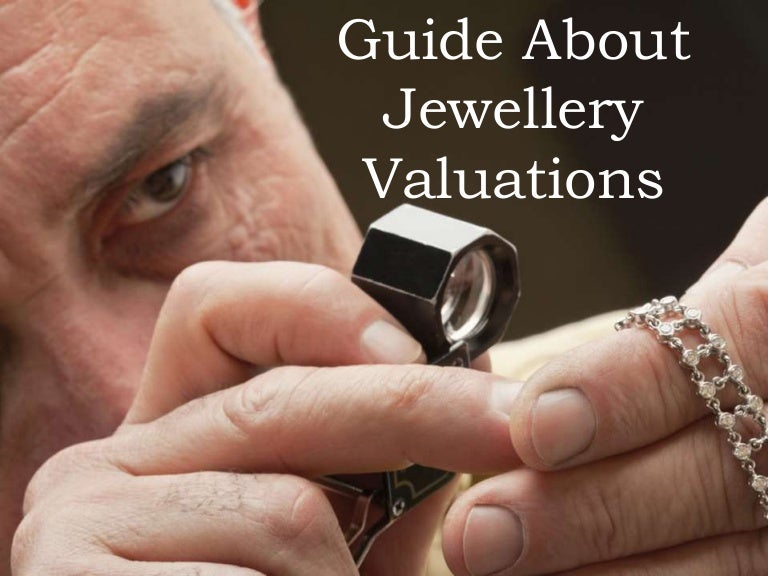

This method involves a professional evaluation by a certified gemologist or valuer. They possess specialized knowledge and expertise in identifying, grading, and assessing the value of gemstones and jewellery. The appraisal process typically includes:

- Examination: A meticulous inspection of the piece, including its materials, craftsmanship, design, and condition.

- Documentation: Detailed documentation of the findings, including a description of the piece, its characteristics, and its estimated value.

- Valuation Report: A comprehensive report outlining the valuation methodology, supporting documentation, and the appraised value.

2. Retail Replacement Value:

This method estimates the cost of replacing the jewellery with a similar piece from a reputable retailer. It considers current market prices for comparable items, taking into account factors such as design, materials, and quality.

3. Agreed Value:

This approach involves negotiating a specific value for the jewellery with your insurer. It is often used for high-value pieces where obtaining a formal appraisal might be challenging or expensive.

4. Auction Value:

This method estimates the potential selling price of the jewellery at a reputable auction house. It considers factors such as the piece’s rarity, historical significance, and market demand.

Factors Influencing Jewellery Valuation

Several key factors influence the valuation of jewellery, impacting the final price:

1. Gemstones:

- Type: Diamonds, emeralds, sapphires, rubies, and other gemstones have distinct values based on their rarity, color, clarity, and cut.

- Carat Weight: The weight of a gemstone is measured in carats. Larger gemstones generally command higher prices.

- Color: Gemstones are graded based on their color intensity, saturation, and hue. Vivid and desirable colors are more valuable.

- Clarity: The presence of inclusions or imperfections within a gemstone affects its clarity and value.

- Cut: The way a gemstone is cut influences its brilliance, fire, and overall beauty.

2. Metal:

- Type: Precious metals like gold, platinum, and silver are valued based on their purity and market prices.

- Weight: The weight of the metal used in the jewellery influences its value.

- Hallmarks: Hallmarks are markings indicating the metal’s purity and origin. They can enhance the value of the piece.

3. Design and Craftsmanship:

- Style: The style and design of the jewellery play a significant role in its value. Unique or rare designs often command higher prices.

- Craftsmanship: The skill and artistry involved in creating the jewellery influence its value. Handcrafted pieces are generally more valuable than mass-produced items.

- Brand: Renowned jewellery brands often have a premium associated with their name and reputation.

4. Condition:

- Wear and Tear: The condition of the jewellery, including signs of wear, scratches, or damage, affects its value.

- Maintenance: Regular cleaning and maintenance can preserve the jewellery’s condition and enhance its value.

5. Market Trends:

- Demand: The demand for specific types of jewellery can fluctuate, impacting their value.

- Economic Conditions: Economic factors like inflation and currency fluctuations can influence the value of precious metals and gemstones.

Tips for Valuing Jewellery for Insurance

- Choose a Reputable Valuer: Select a certified gemologist or valuer with experience and expertise in jewellery valuation.

- Obtain a Comprehensive Appraisal: Ensure the appraisal report includes detailed descriptions, photographs, and a clear statement of the appraised value.

- Update Valuations Regularly: Jewellery values can fluctuate over time. It is recommended to update appraisals every 3-5 years to reflect current market conditions.

- Consider Insurance Options: Discuss your insurance needs with a qualified broker or agent to determine the most suitable coverage for your jewellery.

- Store Jewellery Securely: Protect your jewellery from theft or damage by storing it in a safe place.

FAQs about Jewellery Valuation for Insurance

1. How often should I get my jewellery appraised for insurance purposes?

It is recommended to update appraisals every 3-5 years to reflect changes in market conditions and the value of your jewellery.

2. Do I need an appraisal for all my jewellery?

Appraisals are generally recommended for high-value pieces, especially those exceeding a certain threshold set by your insurer. However, it is wise to have appraisals for all valuable jewellery to ensure accurate insurance coverage.

3. What should I do if my jewellery has been damaged or lost?

If your jewellery has been damaged or lost, contact your insurer immediately. Provide them with the appraisal documentation and any other relevant information.

4. What types of insurance policies cover jewellery?

There are various insurance policies that cover jewellery, including homeowners’ insurance, renters’ insurance, and specialized jewellery insurance.

5. How can I find a reputable jewellery appraiser?

You can find reputable jewellery appraisers through professional organizations like the Gemological Institute of America (GIA) or the American Society of Appraisers (ASA).

Conclusion

Valuing jewellery for insurance is an essential step in safeguarding your precious possessions. By understanding the factors that influence valuation and the different methods employed, you can ensure that you have adequate insurance coverage to protect your investment. Remember to choose a reputable valuer, obtain a comprehensive appraisal, and update valuations regularly to keep pace with market fluctuations. With proper valuation and insurance, you can enjoy the beauty and value of your jewellery with peace of mind.

Closure

Thus, we hope this article has provided valuable insights into The Essential Guide to Jewellery Valuation for Insurance. We appreciate your attention to our article. See you in our next article!