Shielding Your Treasures: A Guide To Top Jewelry Insurance Companies

Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies

Related Articles: Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies

- 2 Introduction

- 3 Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies

- 3.1 The Importance of Jewelry Insurance

- 3.2 Factors to Consider When Choosing Jewelry Insurance

- 3.3 Top 10 Jewelry Insurance Companies: A Comparative Analysis

- 3.4 FAQs: Addressing Common Concerns

- 3.5 Conclusion: Safeguarding Your Treasures

- 4 Closure

Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies

Jewelry, a symbol of love, style, and heritage, holds immense sentimental and financial value. Protecting these precious possessions from unforeseen events is paramount, and jewelry insurance emerges as a vital safeguard. This comprehensive guide delves into the realm of top jewelry insurance companies, offering insights into their offerings, strengths, and considerations to help you make an informed decision for securing your cherished pieces.

The Importance of Jewelry Insurance

Jewelry insurance serves as a financial safety net against a range of perils, including:

- Theft: Whether at home, during travel, or in public spaces, theft poses a significant risk to jewelry.

- Damage: Accidents, natural disasters, and wear and tear can cause damage to jewelry, diminishing its value.

- Loss: Misplacement, accidental dropping, and other unforeseen circumstances can lead to the loss of treasured jewelry.

By insuring your jewelry, you mitigate the financial burden associated with these events, ensuring you can replace or repair your cherished pieces without enduring substantial financial strain.

Factors to Consider When Choosing Jewelry Insurance

Selecting the right jewelry insurance provider involves careful consideration of various factors:

- Coverage: The extent of coverage offered by different companies can vary. Assess whether the policy covers theft, damage, loss, and other potential risks.

- Valuation: The value of your jewelry plays a crucial role in determining the insurance premium. Ensure the chosen policy provides adequate coverage for the estimated value of your pieces.

- Deductible: The deductible is the amount you pay out of pocket before the insurance coverage kicks in. A higher deductible often translates to lower premiums.

- Premium: The cost of the insurance policy is a significant factor. Compare premiums from different companies to find a balance between coverage and affordability.

- Reputation: Research the reputation of the insurance company, considering customer reviews, financial stability, and claims handling processes.

Top 10 Jewelry Insurance Companies: A Comparative Analysis

Here’s a comprehensive overview of ten leading jewelry insurance companies, highlighting their key features and strengths:

1. Jewelers Mutual Insurance Company:

- Strengths: A highly specialized jewelry insurance provider with a long history and strong reputation for customer service.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from reputable gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are competitive and often considered reasonable.

2. Chubb Insurance:

- Strengths: A global insurance giant known for its high-net-worth clientele and premium service.

- Coverage: Provides comprehensive coverage for theft, damage, and loss, including coverage for accidental damage.

- Valuation: Offers appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are typically on the higher end due to the company’s focus on high-value coverage.

3. AIG Private Client Group:

- Strengths: Specializes in providing insurance for high-net-worth individuals and families, offering personalized coverage options.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are typically on the higher end due to the company’s focus on high-value coverage.

4. Hiscox:

- Strengths: A leading provider of specialized insurance solutions, including jewelry insurance.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

5. Travelers Insurance:

- Strengths: A well-established insurance company with a broad range of insurance products, including jewelry insurance.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

6. Nationwide Insurance:

- Strengths: A major insurance company with a strong presence in the United States, offering a variety of insurance products.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

7. State Farm Insurance:

- Strengths: A leading insurance company known for its customer service and affordability.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

8. Liberty Mutual Insurance:

- Strengths: A major insurance company with a wide range of insurance products, including jewelry insurance.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

9. Allstate Insurance:

- Strengths: A major insurance company known for its advertising and customer service.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

10. USAA:

- Strengths: Specializes in providing insurance and financial services to military personnel and their families.

- Coverage: Offers comprehensive coverage for theft, damage, and loss, including coverage for accidental damage and mysterious disappearance.

- Valuation: Provides appraisal services and accepts appraisals from accredited gemologists.

- Deductibles: Offers flexible deductible options.

- Premiums: Premiums are generally competitive and considered reasonable.

FAQs: Addressing Common Concerns

1. What information is required to obtain a jewelry insurance quote?

To obtain a jewelry insurance quote, you’ll typically need to provide details about your jewelry, including:

- Type of jewelry: Rings, necklaces, earrings, bracelets, watches, etc.

- Materials: Gold, platinum, silver, diamonds, gemstones, etc.

- Carat weight: For diamonds and gemstones.

- Estimated value: Based on recent appraisals or market prices.

- Location of storage: Home, safe deposit box, etc.

2. How often should I have my jewelry appraised?

It’s recommended to have your jewelry appraised every 3-5 years, especially for valuable pieces. This ensures that the valuation reflects any fluctuations in market prices and helps you maintain adequate insurance coverage.

3. What happens if my jewelry is lost or stolen while I’m traveling?

Most jewelry insurance policies provide coverage for loss or theft while traveling, both domestically and internationally. However, it’s important to review the specific terms of your policy to understand the coverage limitations and any necessary procedures for filing a claim.

4. What are the steps involved in filing a claim?

The claim filing process typically involves the following steps:

- Contact the insurance company: Report the loss or damage to the insurance company.

- Provide documentation: Submit necessary documentation, including the appraisal, proof of purchase, and police report (if applicable).

- Complete a claim form: Fill out and submit the claim form provided by the insurance company.

- Await processing: The insurance company will review your claim and process it according to their guidelines.

5. Are there any exclusions or limitations in jewelry insurance policies?

Most jewelry insurance policies have exclusions or limitations, such as:

- Pre-existing conditions: Damage or loss that occurred before the policy’s effective date.

- Wear and tear: Normal wear and tear on jewelry is typically not covered.

- Negligence: Loss or damage caused by negligence or intentional acts.

- Certain perils: Some policies may exclude coverage for specific perils, such as war or nuclear events.

6. Can I insure my jewelry through my homeowner’s or renter’s insurance policy?

While some homeowner’s or renter’s insurance policies offer limited coverage for jewelry, it’s typically insufficient for valuable pieces. Specialized jewelry insurance provides more comprehensive coverage and protection for your cherished possessions.

7. How do I choose the right deductible for my jewelry insurance policy?

The choice of deductible depends on your risk tolerance and financial situation. A higher deductible generally results in lower premiums, but you’ll need to pay more out of pocket in case of a claim. Conversely, a lower deductible means higher premiums but a lower out-of-pocket expense.

8. What are the benefits of purchasing a floater policy for my jewelry?

A floater policy is a separate insurance policy that provides coverage for specific valuable items, such as jewelry. It offers greater flexibility and customization compared to standard homeowner’s or renter’s insurance policies.

9. Can I insure multiple pieces of jewelry under a single policy?

Most jewelry insurance companies allow you to insure multiple pieces of jewelry under a single policy. You’ll need to provide details about each piece, including its description, materials, and estimated value.

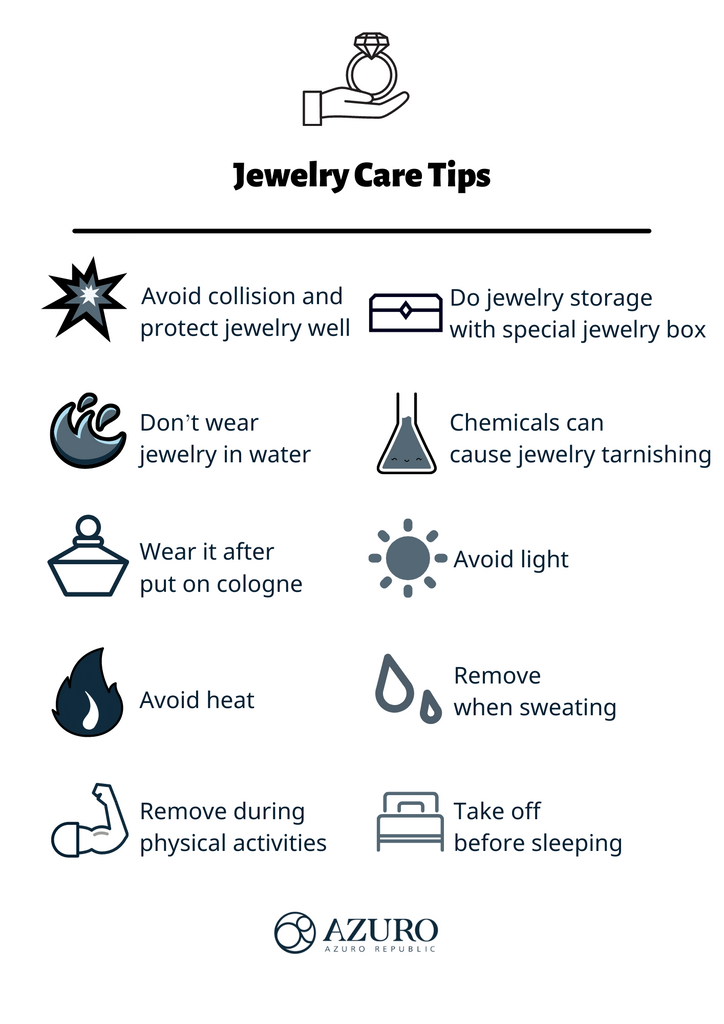

10. What are some tips for preventing jewelry theft or damage?

To minimize the risk of theft or damage to your jewelry:

- Store jewelry securely: Use a safe deposit box or a home safe to store valuable jewelry.

- Avoid wearing expensive jewelry in high-risk areas: Consider leaving your most valuable pieces at home when traveling to areas known for theft.

- Be cautious when traveling: Take precautions when traveling, such as keeping your jewelry in a secure location and avoiding flaunting it in public.

- Regularly maintain your jewelry: Get your jewelry cleaned and inspected by a professional to prevent wear and tear.

Conclusion: Safeguarding Your Treasures

Jewelry insurance provides peace of mind and financial protection for your valuable possessions. By carefully considering the factors discussed in this guide and comparing offerings from top insurance companies, you can choose a policy that aligns with your needs and budget, ensuring that your cherished pieces are adequately protected against unforeseen events.

Closure

Thus, we hope this article has provided valuable insights into Shielding Your Treasures: A Guide to Top Jewelry Insurance Companies. We thank you for taking the time to read this article. See you in our next article!