Safeguarding Your Sparkle: A Guide To Top Jewelry Insurance Companies

Safeguarding Your Sparkle: A Guide to Top Jewelry Insurance Companies

Related Articles: Safeguarding Your Sparkle: A Guide to Top Jewelry Insurance Companies

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Safeguarding Your Sparkle: A Guide to Top Jewelry Insurance Companies. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Safeguarding Your Sparkle: A Guide to Top Jewelry Insurance Companies

Jewelry, with its intrinsic beauty and sentimental value, often represents more than just material possessions. It holds memories, marks milestones, and symbolizes love and commitment. Therefore, protecting these precious items from unforeseen events is crucial. Jewelry insurance serves as a vital safety net, providing financial security in the event of loss, damage, or theft.

This comprehensive guide explores the landscape of top jewelry insurance companies, offering insights into their offerings, coverage options, and factors to consider when selecting the right insurer for your needs.

Understanding Jewelry Insurance: Beyond the Basics

Jewelry insurance differs from standard homeowner’s or renter’s insurance policies. While these policies typically offer limited coverage for jewelry, dedicated jewelry insurance provides specialized protection tailored to the unique risks associated with precious metals and gemstones.

Key Features of Jewelry Insurance:

- Comprehensive Coverage: Policies typically cover loss, damage, or theft due to various perils, including fire, theft, accidental damage, and natural disasters.

- Valuation and Appraisal: Accurate appraisal of your jewelry is essential for determining the coverage amount. Reputable insurers often require professional appraisals from certified gemologists.

- Replacement Cost Coverage: This ensures you receive compensation for the full replacement value of your jewelry, even if it has appreciated in value since purchase.

- Worldwide Coverage: Many policies extend coverage beyond your home country, providing peace of mind during travel.

- Optional Add-ons: Some insurers offer additional coverage for specific risks, such as accidental damage to engagement rings, or coverage for jewelry used in professional settings.

Factors to Consider When Choosing Jewelry Insurance:

- Value of Your Jewelry: The total value of your jewelry collection directly impacts the premium you pay.

- Coverage Limits: Determine the maximum coverage amount offered by different insurers to ensure it aligns with the value of your jewelry.

- Deductibles: Deductibles are the out-of-pocket expenses you pay before your insurance coverage kicks in.

- Claims Process: Understand the claims process, including required documentation and timelines, to ensure a smooth experience in case of an unfortunate event.

- Reputation and Financial Stability: Choose a reputable insurer with a proven track record of handling claims fairly and promptly.

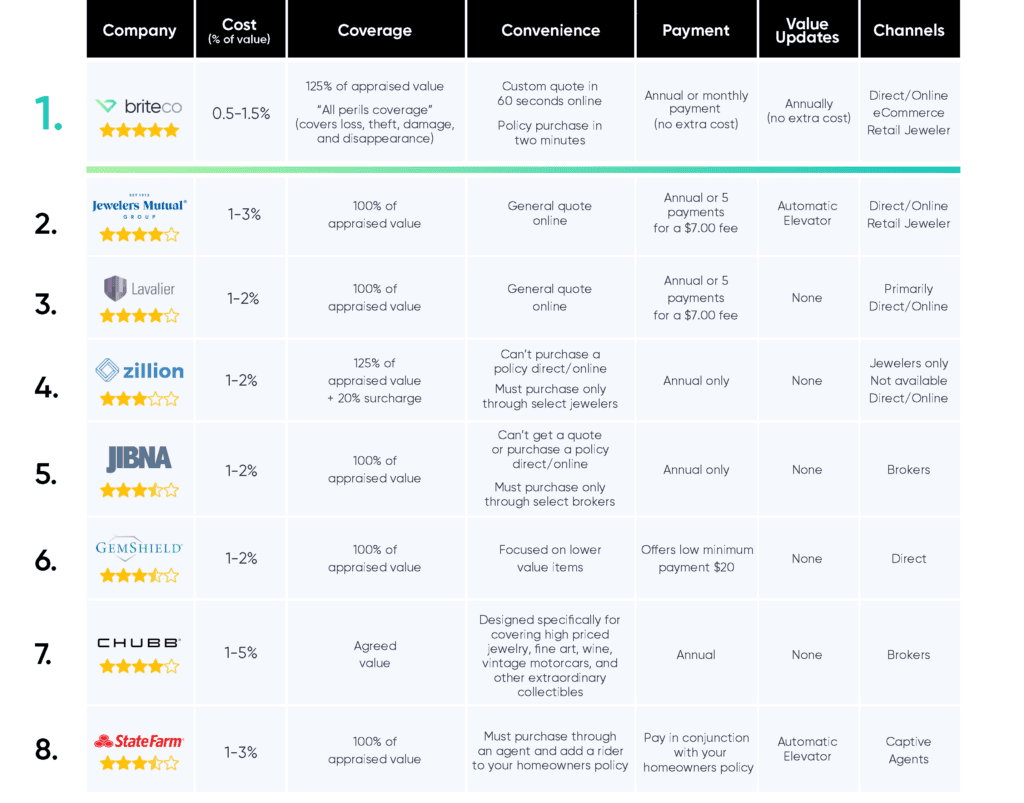

Top Jewelry Insurance Companies: A Comparative Overview

1. Jewelers Mutual Insurance Company

- Founded: 1913

- Focus: Specializes in jewelry insurance, offering comprehensive coverage and a strong reputation for customer service.

-

Key Features:

- Flexible coverage options for various types of jewelry, including antique and heirloom pieces.

- Dedicated jewelry experts available to assist with appraisals and claims.

- Worldwide coverage with no limitations on coverage areas.

-

Pros:

- Long-standing experience in the industry.

- Extensive network of appraisers and repair specialists.

- Excellent customer satisfaction ratings.

-

Cons:

- May have higher premiums compared to some other insurers.

2. Chubb Insurance

- Founded: 1882

- Focus: Offers a wide range of insurance products, including specialized jewelry insurance.

-

Key Features:

- Comprehensive coverage for loss, damage, or theft.

- Option to insure individual pieces or entire collections.

- Access to a global network of experts for appraisals and claims assistance.

-

Pros:

- Strong financial stability and reputation for handling claims efficiently.

- Wide range of coverage options to suit diverse needs.

-

Cons:

- May have stricter underwriting guidelines for certain types of jewelry.

3. AIG Private Client Group

- Founded: 1919

- Focus: Provides insurance solutions for high-net-worth individuals, including comprehensive jewelry insurance.

-

Key Features:

- Tailored coverage options for valuable jewelry collections.

- Access to a dedicated team of specialists for claims handling and risk management.

- Worldwide coverage and 24/7 claims support.

-

Pros:

- Strong financial stability and reputation for providing personalized service.

- Extensive global network for claims assistance.

-

Cons:

- Premiums may be higher due to the specialized nature of their offerings.

4. Nationwide Insurance

- Founded: 1925

- Focus: Provides a range of insurance products, including jewelry insurance as part of their homeowner’s or renter’s policies.

-

Key Features:

- Option to add jewelry coverage to existing policies.

- Coverage for loss, damage, or theft up to a certain limit.

- Access to a nationwide network of agents and claims representatives.

-

Pros:

- Convenient option for those already insured with Nationwide.

- Competitive premiums for basic jewelry coverage.

-

Cons:

- May have limited coverage options compared to specialized jewelry insurers.

5. Travelers Insurance

- Founded: 1853

- Focus: Offers a wide range of insurance products, including specialized jewelry insurance.

-

Key Features:

- Comprehensive coverage for loss, damage, or theft.

- Option to insure individual pieces or entire collections.

- Access to a global network of experts for appraisals and claims assistance.

-

Pros:

- Strong financial stability and reputation for handling claims efficiently.

- Wide range of coverage options to suit diverse needs.

-

Cons:

- May have stricter underwriting guidelines for certain types of jewelry.

FAQs by Top Jewelry Insurance Companies

1. What types of jewelry are covered by insurance?

Most jewelry insurance policies cover a wide range of items, including:

- Diamonds, gemstones, and precious metals: Rings, necklaces, earrings, bracelets, pendants, and watches.

- Antique and heirloom jewelry: Pieces with historical or sentimental value.

- Costume jewelry: While coverage may be limited, some policies offer protection for valuable costume jewelry.

2. What is the difference between actual cash value and replacement cost coverage?

- Actual cash value (ACV): Pays the depreciated value of your jewelry, based on its current market value.

- Replacement cost coverage: Pays the full cost to replace your jewelry with a similar item, even if its value has increased since purchase.

3. How often should I have my jewelry appraised?

It is recommended to have your jewelry appraised every 3-5 years, or whenever there is a significant change in its value, such as a market fluctuation or a change in gemstone or metal prices.

4. What happens if my jewelry is lost or stolen while traveling?

Most jewelry insurance policies provide worldwide coverage, ensuring your jewelry is protected even while you’re away from home.

5. What documentation do I need to file a claim?

When filing a claim, you will typically need to provide:

- Proof of purchase: Receipts or invoices for your jewelry.

- Appraisal report: A recent appraisal from a certified gemologist.

- Police report: If your jewelry was stolen, you will need a police report filed with the local authorities.

Tips by Top Jewelry Insurance Companies

- Keep detailed records: Maintain a comprehensive inventory of your jewelry, including descriptions, purchase dates, and appraisal values.

- Store your jewelry securely: Use a safe deposit box or a secure safe in your home to store your valuable jewelry.

- Consider additional security measures: Install security systems, alarms, and motion detectors to deter theft.

- Be aware of your surroundings: Take precautions when wearing valuable jewelry in public places.

- Avoid wearing expensive jewelry in high-risk areas: Be mindful of your surroundings and avoid wearing valuable jewelry in areas known for high crime rates.

Conclusion

Protecting your precious jewelry is paramount, and jewelry insurance offers a vital safety net against unforeseen events. By carefully considering your needs, comparing coverage options, and choosing a reputable insurer, you can secure the financial protection you deserve for your cherished possessions. Remember, insurance is not just about financial compensation; it’s about peace of mind, knowing that your treasured items are protected.

![5 Best Jewelry Insurance Companies [2024] Ryan Hart](https://www.ryanhart.org/img/B220132-P01.jpg)

:max_bytes(150000):strip_icc()/LAvalier-9f8a30ff759244cf82635f899dc759e8.png)

:max_bytes(150000):strip_icc()/GemShield-049399c9fd3e4ed1ab84ca1b40b934ea.png)

Closure

Thus, we hope this article has provided valuable insights into Safeguarding Your Sparkle: A Guide to Top Jewelry Insurance Companies. We hope you find this article informative and beneficial. See you in our next article!