Navigating The Value-Added Tax Landscape: A Comprehensive Guide To Gold Jewelry In The UAE

Navigating the Value-Added Tax Landscape: A Comprehensive Guide to Gold Jewelry in the UAE

Related Articles: Navigating the Value-Added Tax Landscape: A Comprehensive Guide to Gold Jewelry in the UAE

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Value-Added Tax Landscape: A Comprehensive Guide to Gold Jewelry in the UAE. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Value-Added Tax Landscape: A Comprehensive Guide to Gold Jewelry in the UAE

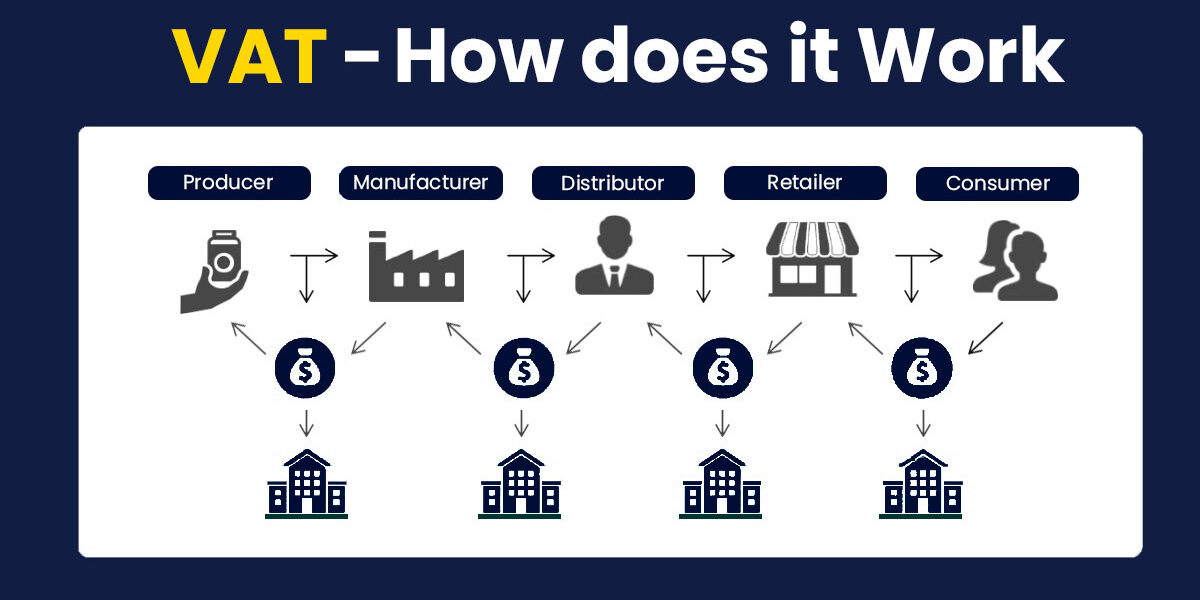

The United Arab Emirates (UAE) implemented a Value-Added Tax (VAT) system in 2018, impacting various sectors, including the gold jewelry industry. Understanding the intricacies of VAT on gold jewelry is crucial for both consumers and businesses operating within the UAE. This guide delves into the specifics of VAT on gold jewelry, providing a comprehensive overview of its application, implications, and considerations.

The Essence of VAT on Gold Jewelry in the UAE:

VAT, a consumption tax levied on the value added at each stage of the production and distribution process, is applied at a standard rate of 5% in the UAE. Gold jewelry, being a luxury item, falls under the category of goods subject to VAT. This means that when you purchase gold jewelry in the UAE, the price you pay includes the 5% VAT on the value of the jewelry.

How VAT is Applied to Gold Jewelry:

The VAT on gold jewelry is calculated based on the total value of the jewelry, including the cost of the gold, craftsmanship, and any additional embellishments. This means that the VAT is not just on the gold itself but on the entire finished product.

VAT Implications for Consumers:

For consumers, understanding the VAT on gold jewelry is vital for budgeting and making informed purchasing decisions. The price displayed on gold jewelry items in stores typically includes the VAT. However, it’s important to note that some retailers may offer promotional deals or discounts, which might affect the final VAT amount.

VAT Implications for Businesses:

For businesses involved in the gold jewelry industry, understanding the VAT implications is crucial for compliance and financial management. They are required to register for VAT if their annual turnover exceeds the threshold set by the Federal Tax Authority (FTA). Registered businesses must charge VAT on their sales of gold jewelry and can claim input VAT on their purchases related to the business.

Key Considerations for VAT on Gold Jewelry:

- Importation: When importing gold jewelry into the UAE, importers are responsible for paying VAT on the imported goods. This VAT is typically included in the import duty and other related charges.

- Exportation: If gold jewelry is exported from the UAE, VAT can be reclaimed by the exporter. This is done by providing the relevant documentation to the FTA.

- Exemptions: Certain types of gold jewelry, such as those used for religious purposes or for specific medical treatments, might be exempt from VAT. However, it’s important to consult with the FTA to confirm the specific exemptions.

FAQs on VAT on Gold Jewelry in the UAE:

1. What is the VAT rate on gold jewelry in the UAE?

The standard VAT rate in the UAE is 5%, which applies to all gold jewelry.

2. Is VAT included in the price of gold jewelry displayed in stores?

Yes, the price displayed on gold jewelry items in stores typically includes the 5% VAT. However, it’s important to check for any promotional deals or discounts that may affect the final price.

3. Can I claim a refund on the VAT paid on gold jewelry purchased in the UAE?

Currently, there is no mechanism for tourists or visitors to claim a refund on VAT paid on gold jewelry purchased in the UAE.

4. How can I calculate the VAT amount on a gold jewelry item?

The VAT amount can be calculated by multiplying the price of the jewelry by 5%. For example, if a gold necklace costs AED 10,000, the VAT would be AED 500.

5. Are there any specific exemptions from VAT on gold jewelry?

Certain types of gold jewelry, such as those used for religious purposes or for specific medical treatments, might be exempt from VAT. However, it’s important to consult with the FTA to confirm the specific exemptions.

Tips for Understanding and Managing VAT on Gold Jewelry:

- Stay informed: Keep abreast of any changes or updates to VAT regulations related to gold jewelry. The FTA website and other official sources provide the latest information.

- Seek professional advice: If you’re unsure about any aspect of VAT on gold jewelry, consult with a tax advisor or financial professional.

- Maintain accurate records: Businesses dealing with gold jewelry should maintain accurate records of all transactions, including sales, purchases, and VAT calculations.

- Claim input VAT: Businesses can claim input VAT on purchases related to their gold jewelry business. This can help reduce their overall tax liability.

- Check for promotional offers: Be aware of any promotional deals or discounts that may affect the VAT amount on gold jewelry.

Conclusion:

The implementation of VAT in the UAE has brought about significant changes in the gold jewelry industry. Understanding the implications of VAT is essential for both consumers and businesses to navigate the market effectively. By staying informed about the regulations, seeking professional advice when needed, and adhering to compliance requirements, individuals and businesses can ensure smooth transactions and financial management within the VAT framework. The VAT system, while adding an additional layer of complexity, ultimately contributes to the overall economic development and stability of the UAE, fostering a transparent and regulated market for gold jewelry.

.png%3Falt%3Dmediau0026w=1200u0026q=75)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Value-Added Tax Landscape: A Comprehensive Guide to Gold Jewelry in the UAE. We appreciate your attention to our article. See you in our next article!